Those who don't pay their taxes on time cause problems for both governments and fellow taxpayers. It has an impact on governments’ available budgets to keep everything running and can create extra costs for tax administrations.

Chasing unpaid taxes weighs on administrations as it is time- and resource-intensive. Therefore, several tax administrations in Member States have been building expertise in behavioural insights to understand better how taxpayers make decisions. The goal is to try targeted interventions, to make the tax process easier and more understandable for taxpayers and as a result, increase compliance.

Supporting structural reform projects

The European Commission is supporting Austria, Belgium, and Portugal to improve tax compliance with behavioural insights by providing funding and technical expertise through its Technical Support Instrument (TSI) managed by the Reform and Investment Task Force – SG REFORM.

The EU Policy Lab is supporting the project, and has been providing training to tax administrations in the three countries. The training sessions covered a range of topics, including:

- Understanding the behavioural factors that lead to non-compliance and how to address them effectively

- Using experiments and evidence-based strategies to evaluate the impact of interventions as part of a culture of continuous improvement

- Improving communication with taxpayers through techniques that resonate with them

- Implementing low-cost interventions that can deliver significant results

- Building positive relationships with taxpayers by addressing their pain points and reducing frustration

- Developing creative and data-backed solutions to longstanding compliance challenges

Tackling the taxpayer journey

We combined the expertise of the Behavioural Insights and the Design for Policy teams to help tax administrations build capacity and apply useful methods to identify where the main pain points are in the taxpayer journey and to define where and how to intervene. An example is improving the timing of when important information is communicated and making it easier to understand and act upon.

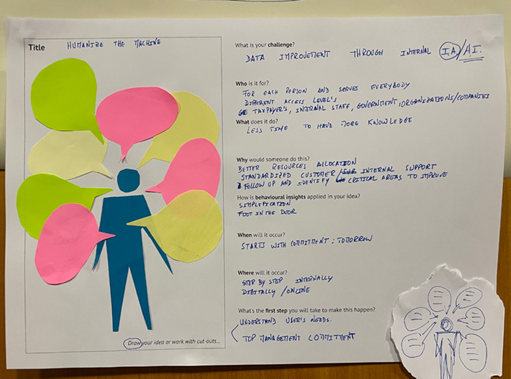

In one workshop, for example, we used Design methods by asking participants to create personas - fictional profiles of taxpayers - imagining what their tax journey would be like in an ideal world, versus what actually happens in reality. This exercise helped the participants to understand the various decisions people have to take when paying their taxes, the emotions they might be experiencing, and what barriers and problems they come across. The behavioural insights training picked up on how to identify and design suitable interventions and test their effectiveness.

This project is an excellent illustration of our increasingly cross-cutting approaches to complex challenges. By combining behavioural insights and design methods, tax authorities can cover the full cycle from discovering relevant behavioural factors to designing and testing interventions.

Read more about strengthening tax compliance and stay tuned for more projects leveraging the power of behavioural insights and design for better policymaking.

Details

- Publication date

- 9 April 2025

- Author

- Joint Research Centre

- Department

- Reform and Investment Task Force

- EU Policy Lab tags